Economy & business

The worlds of economy and business are deeply intertwined, each influencing the other in ways that affect everyone from individual households to multinational corporations. Economic forces like inflation, interest rate movements, and currency fluctuations shape the environment in which businesses operate, while business decisions around investment, pricing, and innovation drive economic growth and employment. Understanding this dynamic relationship equips you with the insight needed to make smarter financial decisions, protect your assets, and identify opportunities for growth.

Whether you’re managing personal finances during economic uncertainty, evaluating business investments, navigating regulatory complexities, or building data-driven strategies for customer retention, the fundamental principles remain consistent: measure what matters, adapt to changing conditions, and balance short-term needs with long-term value creation. This comprehensive resource explores the core concepts that connect economic literacy with practical business strategy, providing you with frameworks and actionable insights across seven critical domains.

Economic Forces and Personal Financial Resilience

Economic shifts don’t just make headlines—they directly impact your purchasing power, borrowing costs, and wealth preservation strategies. Understanding these mechanisms transforms abstract economic news into concrete actions you can take to protect and grow your financial position.

How Interest Rates Shape Your Financial Decisions

When central banks adjust interest rates, the ripple effects touch nearly every financial decision you make. Higher rates increase the cost of borrowing for mortgages, car loans, and credit cards, making debt more expensive to carry. Conversely, they often improve returns on savings accounts and fixed-income investments. This creates a critical decision point: during rising rate environments, prioritizing debt repayment often delivers better risk-adjusted returns than seeking investment gains, particularly for high-interest consumer debt.

Inflation’s Hidden Tax on Wealth

Think of inflation as a slow leak in your financial reservoir. Even moderate inflation of three to four percent annually can erode half of your money’s purchasing power within two decades if it sits idle. This reality makes the classic debate between saving and debt repayment more nuanced during inflationary periods. Fixed-rate debt actually becomes less burdensome in real terms as inflation rises, while cash savings lose value. The optimal strategy often involves maintaining emergency liquidity while directing surplus funds toward inflation-resistant assets like equities, real estate, or inflation-indexed instruments.

Currency Fluctuations and Hidden Exposure

Currency risk extends far beyond international travelers. If you hold investments in foreign markets, purchase imported goods regularly, or work for a company with global supply chains, exchange rate movements affect your economic reality. A strengthening domestic currency boosts your purchasing power for imports but may hurt export-oriented employers or international investment returns. Building awareness of these exposures—and potentially diversifying across currency zones—adds an important layer of financial resilience.

Investment Strategy in a Global Landscape

Developing economies represent both compelling opportunities and complex challenges for investors seeking diversification beyond mature markets. The growth potential in these regions often comes packaged with political uncertainty, currency volatility, and regulatory unpredictability that require careful assessment.

The Leapfrog Technology Advantage

One of the most fascinating dynamics in emerging markets is leapfrog adoption—the phenomenon where developing economies skip intermediate technological stages entirely. Countries with limited traditional banking infrastructure have jumped directly to mobile payment ecosystems, bypassing the branch-based banking phase that developed nations spent decades building. Similarly, regions with sparse landline telephone networks have moved straight to mobile connectivity. For investors, these leaps create opportunities in technology platforms, digital services, and infrastructure plays that wouldn’t exist in more developed markets.

Assessing Political and Regulatory Risk

Evaluating emerging market opportunities requires a framework that goes beyond financial metrics. Consider these key dimensions:

- Institutional stability: Rule of law, property rights protection, and contract enforcement mechanisms

- Policy predictability: Government track record on honoring commitments and consistency in economic policy

- Reform trajectory: Direction and pace of structural reforms, particularly around market liberalization and transparency

- Geopolitical positioning: Regional tensions, trade relationships, and alignment with major economic blocs

Timing market entry around reform cycles can dramatically improve risk-adjusted returns. Markets often undervalue positive changes until reforms demonstrate tangible results, creating windows where forward-looking investors can position ahead of broader recognition.

Measuring and Optimizing Business Performance

What gets measured gets managed—but only if you’re measuring the right things. Business performance optimization begins with establishing meaningful metrics that drive decision-making rather than simply documenting activity.

The Power of Compound Efficiency Gains

Small improvements compound remarkably over time. A business process that becomes five percent more efficient each quarter doesn’t just improve by twenty percent annually—it improves by nearly twenty-two percent due to compounding. This principle applies across operations: reducing customer acquisition cost by incremental amounts, improving conversion rates by basis points, or decreasing delivery times by small percentages. The key is establishing rigorous tracking systems that capture these improvements and ensure gains aren’t eroded by regression to old habits.

Building a KPI Dashboard That Drives Action

Effective dashboards balance comprehensiveness with clarity. They should answer three fundamental questions at a glance: Where are we now? Is the trend moving in the right direction? What requires immediate attention? The most successful implementations follow these principles:

- Align metrics with strategic objectives: Every KPI should trace back to a specific business goal

- Distinguish leading from lagging indicators: Leading metrics predict future performance; lagging metrics confirm what already happened

- Establish clear ownership: Each metric needs a responsible party who can influence the outcome

- Set appropriate refresh frequencies: Real-time updates for operational metrics, periodic reviews for strategic measures

The Vanity Metrics Trap

Vanity metrics make you feel good but don’t guide decisions. Total registered users sounds impressive but means little without active user rates. Website traffic appears important until you realize it doesn’t correlate with conversions. Revenue growth seems universally positive until you discover it’s coming from unprofitable customer segments. The antidote is ruthlessly interrogating each metric: “If this number changed, what specific action would we take?” If the answer is unclear, the metric probably doesn’t belong in your core dashboard.

Data-Driven Forecasting and Planning

Forecasting transforms historical patterns into actionable predictions about future states—but only when approached with appropriate rigor and humility about uncertainty.

Forecasting Versus Prediction: A Critical Distinction

Prediction attempts to state what will happen; forecasting estimates what might happen within a range of probabilities. This distinction matters profoundly for planning. A supply chain forecast that projects demand between eight hundred and one thousand two hundred units with eighty percent confidence enables better decision-making than a false-precision prediction of exactly nine hundred seventy-three units. The forecast acknowledges uncertainty and allows you to plan for scenarios; the prediction creates brittle strategies that break when reality deviates.

Choosing Model Variables and Avoiding Overfitting

The temptation in forecasting is adding variables until your model perfectly explains historical data. This overfitting creates models that describe the past beautifully but fail miserably at predicting the future because they’ve learned the noise rather than the signal. A robust forecasting approach starts with domain expertise to identify genuinely causal variables, then applies statistical techniques to validate their predictive power. Often, simpler models with fewer well-chosen variables outperform complex models with dozens of inputs.

Communicating Probability to Decision Makers

The most sophisticated forecast fails if stakeholders can’t interpret it correctly. Effective communication requires translating probability distributions into business implications. Instead of stating “seventy percent confidence interval of five hundred to seven hundred units,” frame it as “we should prepare inventory for six hundred units, maintain flexibility to scale to seven hundred, and have contingency plans if demand drops below five hundred.” This approach converts statistical outputs into operational directives that teams can execute.

Business Intelligence and Speed-of-Thought Decisions

The gap between data availability and decision-making represents one of the largest sources of competitive advantage in modern business. Organizations that compress this latency act while competitors are still assembling reports.

Self-Service BI Versus Curated Reports

The debate between self-service business intelligence and curated reporting isn’t binary—it’s about finding the right balance for your organization’s maturity and needs. Curated reports ensure consistency, prevent misinterpretation, and work well for stable, recurring decisions. Self-service BI empowers teams to explore data independently, ask novel questions, and respond to emerging situations without waiting for analyst support. The optimal approach typically involves a core set of standardized reports for governance and operational consistency, supplemented by self-service tools for exploration and ad-hoc analysis.

Creating a Data-Driven Culture

Technology enables data-driven decision-making, but culture determines whether it actually happens. Building this culture requires several foundational elements:

- Accessible data: Information must be discoverable and understandable without specialized technical knowledge

- Psychological safety: Teams need permission to challenge assumptions with data, even when it contradicts senior opinions

- Clear definitions: Shared understanding of how metrics are calculated and what they represent

- Training investment: Developing data literacy across the organization, not just within specialist teams

The transition from intuition-based to data-informed decision-making takes time, but organizations that successfully make this shift can respond to market changes with remarkable agility.

Regulatory Compliance and Risk Management

Data privacy regulations have transformed from theoretical legal concerns into operational realities with substantial financial and reputational consequences. Organizations face a complex web of requirements that vary by jurisdiction, industry, and data type.

Cross-Border Data Transfer Complexities

Moving personal data across national borders triggers multiple regulatory frameworks simultaneously. A company transferring customer information from the European Union to servers in other regions must navigate adequacy decisions, standard contractual clauses, or binding corporate rules. These aren’t merely paperwork exercises—they require technical controls, regular audits, and the ability to demonstrate compliance during regulatory scrutiny. The operational overhead of maintaining compliant cross-border data flows has led many organizations to adopt data residency strategies, keeping data within the jurisdiction where it was collected.

Automating Compliance Reporting

Manual compliance processes don’t scale with regulatory complexity. Automated systems that continuously monitor data processing activities, track consent status, and flag potential violations enable proactive compliance rather than reactive firefighting. These systems become especially critical for handling data subject rights—the ability to export, correct, or delete personal information upon request within legally mandated timeframes.

Preparing for Regulatory Audits

The organizations that handle audits most smoothly treat them as inevitable rather than hypothetical. This mindset shift drives concrete preparations: maintaining current data processing inventories, documenting decision-making around privacy by design, preserving evidence of privacy impact assessments, and conducting regular internal audits that simulate regulatory scrutiny. When an actual audit occurs, these organizations spend their time answering substantive questions rather than frantically assembling basic documentation.

Customer Retention and Lifetime Value Strategy

Acquiring customers is expensive; retaining them is profitable. This fundamental truth drives increasing focus on customer lifetime value optimization through strategic retention efforts and churn prevention.

Red Flag Metrics That Predict Churn

Customer churn rarely happens suddenly—it’s typically the culmination of declining engagement that produces detectable signals. Usage frequency decreases precede cancellations by weeks or months. Support ticket volume and sentiment shifts indicate growing frustration. Feature adoption rates reveal whether customers are discovering value or stagnating with basic functionality. Payment friction events like declined cards or billing disputes correlate strongly with subsequent churn. By monitoring these leading indicators, organizations can intervene before customers make final exit decisions.

The Psychology and Economics of Onboarding

The onboarding window represents a critical period where customers form lasting impressions about product value. Psychologically, people seek validation for their purchase decision during this phase—they want to believe they made the right choice. Operationally, customers who reach specific activation milestones within their first week show dramatically higher retention rates than those who don’t. This creates a clear imperative: design onboarding sequences that guide users to those “aha moments” as quickly as possible, whether through progressive feature introduction, personalized guidance, or strategic human touchpoints.

Balancing Personalization Against Privacy Concerns

Personalization drives engagement, but invasive personalization drives customers away. The optimal approach respects context and consent: using behavioral data to improve user experience in transparent ways, providing clear value in exchange for information sharing, and giving customers granular control over their privacy preferences. Organizations that get this balance right see personalization become a competitive advantage rather than a liability.

The intersection of economic understanding and business strategy creates powerful advantages for individuals and organizations willing to develop these competencies. By grasping how macroeconomic forces affect personal finances, evaluating investment opportunities through appropriate risk frameworks, measuring performance with meaningful metrics, forecasting intelligently, leveraging data for rapid decisions, maintaining regulatory compliance, and optimizing customer lifetime value, you build resilience and create opportunities regardless of market conditions. Each of these domains offers deep areas for further exploration based on your specific circumstances and goals.

How to Calculate Customer Lifetime Value to Justify Retention Budgets?

The key to securing retention budget is to stop talking about historical CLV and start proving the ROI of retention with a profit-adjusted, predictive model. Identify leading churn indicators, like…

Read more

How to Translate Raw Data into Actionable Insights for Non-Technical C-Suites?

The real reason your C-suite ignores your reports isn’t the data’s complexity; it’s the lack of a strategic translation layer. Move beyond what the data says to what it means…

Read more

How to Use Predictive Modeling to Reduce Inventory Overstock by 20%?

The key to cutting overstock isn’t just adopting predictive modeling; it’s mastering the framework to translate its statistical outputs into quantifiable financial trade-offs for your C-suite. Predictive modeling moves beyond…

Read more

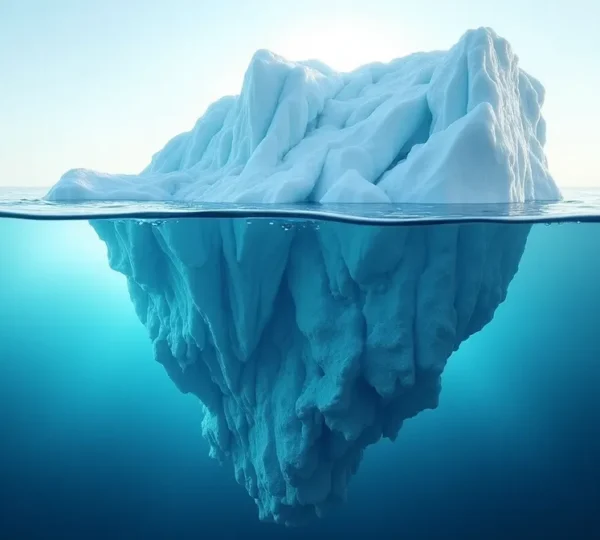

The Hidden Cost of Non-Compliance: Why GDPR Fines Are Just the Tip of the Iceberg

Contrary to the common belief that GDPR risk is limited to fines, non-compliance is a symptom of deep systemic failures in technical architecture and operational processes, exposing directors to personal…

Read more

Why Focusing Solely on Revenue Instead of Margin Kills ROI?

Chasing revenue growth while ignoring margin is the fastest way to build a busy, cash-flow-positive company that generates zero actual profit. Improving customer retention by a small fraction has an…

Read more

Which Emerging Markets Show the Most Stability for Tech Investments?

The most stable emerging market investment isn’t a country; it’s a business model structurally insulated from local risk. True stability comes from companies with “natural hedges,” such as earning in…

Read more

The Silent Heist: How Global Inflation Systematically Erodes Your Savings

Inflation is not a passive economic condition; it is an active process, directly driven by macroeconomic policies that systematically dismantle your financial stability. Central bank rate hikes are designed to…

Read more