Contrary to the common belief that GDPR risk is limited to fines, non-compliance is a symptom of deep systemic failures in technical architecture and operational processes, exposing directors to personal liability.

- The largest penalties are not just for breaches, but for fundamental flaws in data transfer mechanisms and database design that make compliance impossible.

- Operational negligence, such as poor documentation and inadequate vendor audits, creates cascading liabilities that extend far beyond a single security incident.

Recommendation: Shift focus from a box-ticking compliance exercise to a systemic audit of your data governance, technical architecture, and supply chain to mitigate catastrophic and often hidden risks.

For many business owners, General Data Protection Regulation (GDPR) compliance is perceived as a burdensome, bureaucratic exercise—a cost center defined by checklists and the looming threat of financial penalties. The conversation often revolves around the staggering figures, such as fines up to €20 million or 4% of global annual turnover. Consequently, the primary goal becomes avoiding the fine, treating compliance as a destination rather than a continuous operational discipline.

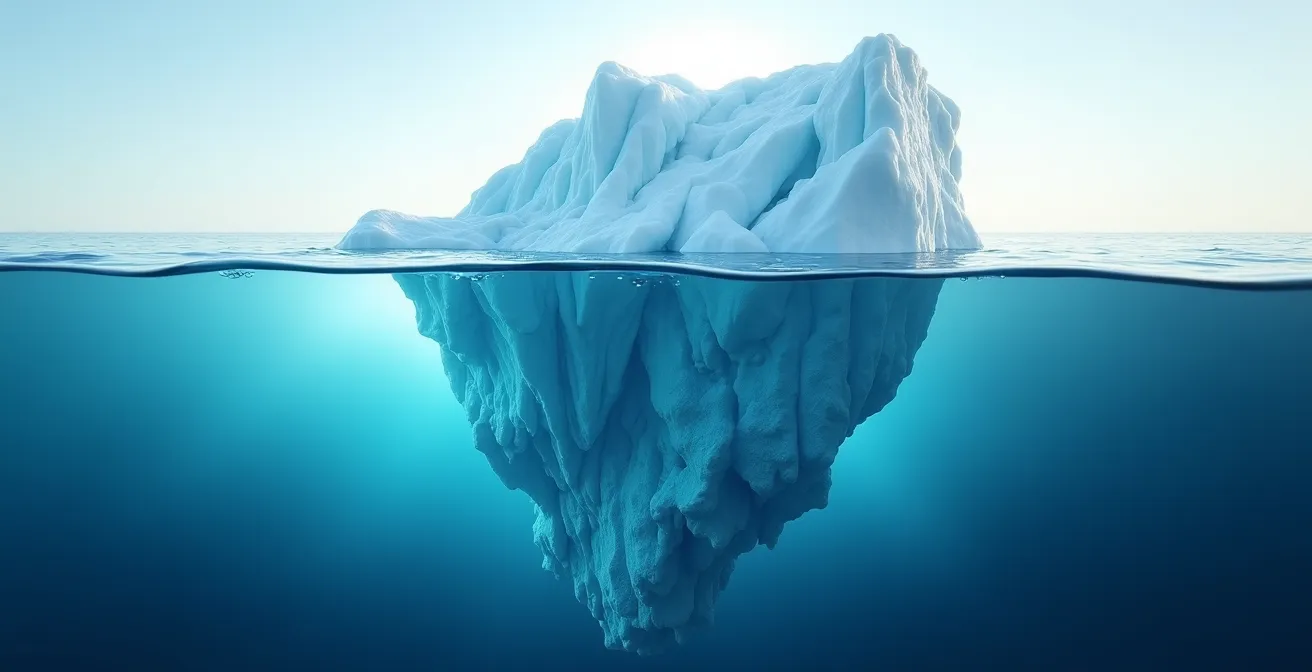

This perspective, however, is dangerously myopic. It fixates on the most visible consequence while ignoring the vast, submerged part of the iceberg. The fines, as substantial as they are, are merely the final, public symptom of a much deeper organizational disease. They are the result of systemic failures, not isolated mistakes. True risk extends into operational paralysis, domain blacklisting, loss of investor confidence, and even personal liability for an organization’s leadership.

But what if the key to mitigating this risk lies not in reacting to regulations, but in proactively rooting out the architectural flaws and operational negligence that make non-compliance inevitable? The true cost of non-compliance is not the fine itself, but the underlying compliance debt that has been allowed to accumulate within your systems and processes. This is not a legal problem to be delegated; it is a fundamental business and technical challenge.

This analysis will deconstruct the hidden liabilities of GDPR non-compliance. We will move beyond the headlines to examine the specific technical and procedural failures that trigger regulatory action, from flawed data transfer protocols to database architectures that render user rights unenforceable. The objective is to provide a clear, risk-focused framework for understanding and addressing the systemic nature of data privacy obligations.

Summary: The Hidden Cost of Non-Compliance: Why GDPR Fines Are Just the Tip of the Iceberg?

- How to Transfer Customer Data Between EU and US Without Breaking GDPR?

- Manual Audits vs Automated Compliance: Which Survives a Regulator Visit?

- The Database Architecture Error That Makes “Right to Be Forgotten” Impossible

- The Email Consent Mistake That Can Blacklist Your Domain Globally

- How to Organize Your Documentation so an Audit Takes Days Instead of Weeks?

- The Legal Oversight That Costs Foreign Investors Thousands in Fines

- How to Audit Your Supply Chain Partners for Cybersecurity Vulnerabilities?

- Why Your Big Data Project Will Fail Without a Robust Data Governance Strategy?

How to Transfer Customer Data Between EU and US Without Breaking GDPR?

The transfer of personal data from the European Union to the United States remains one of the most litigated and financially hazardous areas of GDPR. Many organizations mistakenly believe that a simple contractual clause suffices, a misunderstanding that exposes them to catastrophic legal and financial risk. The core of the issue lies in the conflict between EU privacy rights and U.S. surveillance laws. Regulators are not just looking for a data processing agreement; they are scrutinizing the fundamental legality of the transfer mechanism itself. The invalidation of frameworks like Privacy Shield has left a complex and treacherous landscape where non-compliance is the default state for the unprepared.

A stark illustration of this risk is the case against Meta, which was penalized for its reliance on Standard Contractual Clauses (SCCs) without adequate supplementary measures to protect data from U.S. intelligence access. The outcome was a €1.2 billion penalty in 2023, the largest GDPR fine ever issued, demonstrating that even the most sophisticated legal teams can fail when the underlying transfer mechanism is deemed insufficient. This sends a clear signal: procedural box-ticking is not a defense. Organizations must actively assess and mitigate the risks posed by the legal framework of the recipient country.

To navigate this, a rigorous, documented process is non-negotiable. It involves a multi-step approach that goes far beyond signing a contract. A compliant framework requires:

- Comprehensive Records: Map and log all data transfers to non-EU countries, including processors and sub-processors.

- Tool Verification: Identify and validate the transfer tools being used under Chapter V of GDPR, such as updated SCCs or Binding Corporate Rules (BCRs).

- Adequacy Assessment: Formally assess whether the recipient country’s legal framework provides a level of protection essentially equivalent to that of the EU.

- Supplementary Measures: Implement robust technical measures, such as strong end-to-end encryption and strict key management, where the data exporter retains control of the keys.

- Procedural Documentation: Document every step of the assessment and the rationale for the implemented measures.

- Regular Re-evaluation: Continuously monitor legal and political developments in the recipient country and re-evaluate the transfer mechanism accordingly.

Failure in any of these areas constitutes a systemic failure, rendering the entire data transfer operation unlawful. The question from a regulator will not be “Do you have an SCC?” but “Show us your documented assessment and the supplementary measures you have implemented to ensure data protection in practice.”

Manual Audits vs Automated Compliance: Which Survives a Regulator Visit?

In the event of a regulatory investigation, organizations face two distinct paths for demonstrating compliance: the manual audit, characterized by spreadsheets, static documents, and human verification; or the automated approach, driven by integrated software that provides real-time evidence. While manual processes may seem sufficient for internal checks, they often crumble under the pressure of a formal audit. Regulators demand not just a snapshot of compliance but a living, verifiable record of data governance in action. A manual audit is inherently reactive, time-consuming, and prone to human error, making it a significant liability.

The operational cost of manual compliance is a severe hidden drain on resources. Beyond the risk of inaccuracies, it consumes thousands of hours that could be allocated to value-generating activities. For instance, DataGrail research reveals companies spent over 2100 hours in meetings alone on GDPR, a staggering figure that highlights the inefficiency of manual coordination. This time cost represents a significant operational drag, and the resulting documentation is often outdated by the time it is presented to an auditor. Automation transforms compliance from an arduous annual project into a continuous, verifiable state.

The critical difference lies in the ability to produce on-demand, auditable proof. An automated system can instantly generate a Record of Processing Activities (RoPA), trace data flows, and produce evidence of consent for any given data subject. In a manual system, this same request could take weeks, involving frantic coordination between legal, IT, and marketing departments. During a regulator visit, such a delay is not merely inconvenient; it is interpreted as a lack of control and a sign of systemic negligence. Automated compliance platforms provide the “single source of truth” that demonstrates robust governance, while manual records often present a fragmented and contradictory picture.

Therefore, surviving a regulator visit depends less on the theoretical correctness of policies and more on the practical ability to demonstrate their implementation. While manual oversight will always play a role in interpreting complex legal questions, reliance on it for evidence collection is a losing strategy. The future of defensible compliance lies in a hybrid model where human expertise guides the strategy, but technology provides the immutable, real-time proof of execution.

The Database Architecture Error That Makes “Right to Be Forgotten” Impossible

The “Right to be Forgotten” (Article 17 of GDPR) is not merely a policy requirement; it is a profound technical challenge that strikes at the heart of an organization’s data architecture. Many businesses fail to recognize that this right cannot be fulfilled with a simple “delete” command in a poorly designed system. The most common architectural flaw is the failure to design for data dissociation. When a user’s personal data is copied, fragmented, and embedded across multiple databases, log files, backups, and third-party analytics tools without a centralized mapping or unique identifier, complete erasure becomes a practical impossibility.

This isn’t a minor oversight; it’s a fundamental design error that constitutes a direct violation of the GDPR’s core principles, especially data protection by design and by default. According to the GDPR’s seven principles, data processing must be lawful, fair, transparent, and limited to its purpose. A system that cannot locate and erase all instances of a user’s data fails these principles at a structural level. The consequences are severe. A case in point is the Dutch Data Protection Commission’s investigation into Clearview AI. Following a massive fine, regulators are now exploring whether they can hold the company’s directors personally liable for its database architecture decisions. This signals a new era where personal liability for management is a tangible risk stemming directly from technical choices.

A common scenario involves data that has been replicated into a data lake for analytics purposes. While the primary record in the production database might be deleted, the copies used for machine learning models or business intelligence reports often remain. Without a robust data lineage and cataloging system, these “data orphans” are forgotten by the system but still constitute personal data under the law. When a data subject access request (DSAR) for erasure is made, the organization may, in good faith, believe it has complied while leaving countless copies of the data intact—a ticking time bomb for a future audit.

To avoid this architectural flaw, systems must be built with erasure in mind from day one. This involves implementing a centralized data subject registry, using pseudonymization techniques where possible, and ensuring that all data instances are linked via a common identifier that can trigger a cascading deletion across all systems. Retrofitting these capabilities into a legacy system is an immensely complex and expensive task, creating a significant “compliance debt” that grows over time. For a business owner, the critical takeaway is that database design is no longer just an IT decision; it is a core component of legal and financial risk management.

The Email Consent Mistake That Can Blacklist Your Domain Globally

Email marketing remains a powerful tool, but it is also a minefield of GDPR compliance risks. The most prevalent and dangerous mistake is relying on ambiguous, bundled, or pre-ticked consent. Under GDPR, consent must be “freely given, specific, informed, and unambiguous.” Any deviation from this standard not only violates the regulation but can have severe, cascading technical consequences that go far beyond a potential fine. An email sent without valid consent is not just a legal misstep; it is classified as spam by major email providers and spam-filtering services.

When recipients mark unsolicited emails as spam, it sends a negative signal to providers like Google and Microsoft. If these signals reach a critical threshold, your organization’s sending domain and IP addresses can be added to global blacklists. The result is a catastrophic drop in deliverability for all corporate communications, not just marketing. Transactional emails, sales communications, and even internal messages can be blocked or sent directly to junk folders. This operational paralysis can cripple a business far more immediately and damagingly than a slow-moving regulatory investigation. Removing a domain from these blacklists is a difficult and uncertain process, causing lasting reputational and commercial harm.

The mistake often originates from a failure to decouple consent. For example, a single checkbox that says “I agree to the terms of service and to receive marketing emails” is invalid because the consent is not specific or freely given. Each processing purpose requires separate, granular consent. Furthermore, consent records must be meticulously maintained, including the timestamp, the specific wording of the consent request, and the IP address of the user. Without this proof, an organization has no defense when challenged by a data subject or a regulator.

Essential Checklist for Compliant Email Consent

- Implement Unambiguous Language: Use clear, affirmative opt-in mechanisms (e.g., unticked checkboxes) and avoid vague language about sharing data with “partners.”

- Deploy Centralized Preference Centers: Ensure user consent choices are synced in real-time across all systems, including your CRM, email service provider, and advertising networks.

- Document Legitimate Interest: For any processing not based on consent, maintain a detailed Legitimate Interest Assessment (LIA) with specific justifications for each use case.

- Automate Consent Lifecycles: Create automated workflows for handling consent expiry and prompting users for renewal to ensure records remain current.

- Establish Real-Time Validation: Before each marketing email is dispatched, your system must perform a real-time check to validate that a current, valid consent record exists for the recipient, as confirmed by guidelines on consent management.

Treating email consent as a mere formality is a direct path to both legal sanction and technical isolation. A single poorly-worded consent form can trigger a chain reaction that silences your organization’s primary communication channel.

How to Organize Your Documentation so an Audit Takes Days Instead of Weeks?

Under GDPR, the burden of proof rests entirely on the organization. It is not enough to be compliant; you must be able to *demonstrate* compliance on demand. This principle of accountability (Article 5(2)) is where many businesses fail during a regulatory audit. Disorganized, outdated, or incomplete documentation is treated as a sign of non-compliance itself, regardless of the underlying practices. An audit that drags on for weeks due to an inability to produce evidence quickly drains resources, erodes regulator confidence, and significantly increases the likelihood of a negative outcome, including substantial fines.

The critical failure is often treating documentation as an administrative afterthought rather than a dynamic, living system. A folder of static Word documents and PDFs is insufficient. Regulators expect to see a coherent, centralized, and version-controlled repository of all compliance artifacts. This includes Data Protection Impact Assessments (DPIAs), records of processing activities (RoPAs), data processing agreements (DPAs) with vendors, privacy notices, and records of consent. The inability to produce these documents promptly is a major red flag. In a notable case, inadequate documentation contributed to a €310 million fine issued to LinkedIn Ireland in 2024, proving that procedural failings can be as costly as substantive data misuse.

An effective documentation strategy is built on three pillars: centralization, automation, and ownership. Centralization means having a single, accessible repository for all compliance-related documents, preventing version-control chaos. Automation involves using tools to generate and update records like data flow maps and RoPAs in real-time as systems change, eliminating the risk of outdated information. Finally, clear document ownership ensures that a specific individual or team is responsible for maintaining the accuracy of each artifact. Without a designated Data Protection Officer (DPO) or an equivalent role overseeing this process, documentation inevitably falls into disarray.

When a regulator requests a specific document, the goal should be to produce it within hours, not days. A well-organized system allows you to respond with speed and confidence, projecting an image of control and competence. This proactive approach to “audit readiness” can be the deciding factor between a smooth inquiry and a protracted, punitive investigation. The investment in organizing documentation pays for itself by dramatically reducing the friction, cost, and risk associated with regulatory scrutiny.

The Legal Oversight That Costs Foreign Investors Thousands in Fines

Foreign investors, particularly those from the U.S. entering the EU market, often fall prey to a critical legal oversight: underestimating the enforcement authority and sophistication of individual EU Data Protection Authorities (DPAs). There is a misconception that GDPR is a monolithic entity enforced uniformly from Brussels. In reality, enforcement is highly localized, with certain DPAs developing a reputation for aggressive and targeted investigations, especially against foreign-owned tech companies. This creates risk hotspots where the likelihood of scrutiny and significant fines is much higher.

The most prominent example of this is Ireland’s Data Protection Commission (DPC). Due to its role as the lead supervisory authority for many U.S. tech giants with European headquarters in Dublin, the DPC has become the epicenter of high-stakes GDPR enforcement. Since the regulation’s inception, Ireland has reported the highest aggregate fines, exceeding 2.8 billion euros. This is not an accident; it is a direct consequence of a regulatory strategy focused on the complex data processing operations of large, multinational corporations. Foreign investors setting up an EU base in a seemingly business-friendly jurisdiction may inadvertently place themselves in the crosshairs of its most active regulator.

The oversight extends beyond choosing a headquarters. Investors often fail to conduct adequate due diligence on the compliance posture of their acquisition targets or local partners. A foreign company acquiring a European business inherits its existing compliance liabilities. If the target company has a history of poor data hygiene, weak consent mechanisms, or unlawful data transfers, the new owner becomes responsible for those pre-existing systemic failures. Without a thorough pre-acquisition GDPR audit, an investor may be buying a multi-million-euro fine waiting to happen.

Therefore, for foreign investors, risk mitigation requires a jurisdiction-specific legal analysis. It is crucial to understand the enforcement priorities and track record of the DPA in the chosen country of operation. Simply transposing a U.S.-centric view of privacy law onto a European context is a recipe for disaster. The assumption that compliance is a uniform, low-risk matter is a legal blind spot that has already cost investors dearly, with the total sum of GDPR fines demonstrating a clear and upward trend in enforcement severity.

How to Audit Your Supply Chain Partners for Cybersecurity Vulnerabilities?

An organization’s GDPR compliance is only as strong as its weakest link, and that weak link is often a third-party vendor in the supply chain. Under GDPR, you, as the data controller, remain fully liable for a data breach caused by one of your processors. A simple Data Processing Agreement (DPA) is not a shield against liability; it is the bare minimum requirement. Regulators expect you to conduct ongoing due diligence and actively audit the security and compliance posture of every partner with access to personal data. Failure to do so is considered a form of operational negligence.

The risk is compounded by a lack of visibility into the “fourth-party problem”—your vendors’ vendors. A data processor you have vetted may subcontract parts of its service to other companies, creating a complex and often opaque chain of data access. A breach at any point in this chain can be traced back to you as the controller. This concept of cascading liability means that a robust supply chain audit must go beyond surface-level questionnaires and certifications like SOC 2. It requires a deep, intrusive, and continuous verification of your partners’ security practices.

A truly effective supply chain security audit framework must be contractual, technical, and procedural. It should include the following measures:

- Fourth-Party Mapping: Contractually require all vendors to disclose their own sub-processors and the nature of the data they access.

- Transfer Impact Assessments (TIAs): Mandate that any vendor transferring data outside the EU provide a copy of their TIA for your records.

- Aggressive Breach Notification SLAs: Implement contractual clauses requiring vendors to notify you of a potential breach within 24 hours, not the 72 hours afforded by GDPR, to give your team time to investigate.

- Enhanced Security Attestation: Go beyond standard reports and require evidence of specific security controls, such as penetration testing results and vulnerability management policies.

- Continuous Monitoring: Deploy tools that can continuously monitor your vendors’ external security posture for new vulnerabilities or compliance drifts.

- Data Segregation Mandates: Enforce contractual and technical controls that prevent your data from being commingled with that of other clients, limiting the lateral spread of a breach.

–

–

–

–

Trusting vendors to self-report their compliance is a high-risk gamble. The onus is on the data controller to verify, document, and continuously monitor. An audit of your supply chain is not a one-time event but a perpetual process of risk management. Without it, your compliance program has a critical and indefensible blind spot.

Key Takeaways

- GDPR fines are a symptom of deeper, systemic failures in technical design and operational processes, not isolated incidents.

- Personal liability for directors is an emerging and significant risk, linking executive decisions directly to compliance outcomes.

- Effective compliance requires a shift from manual, reactive documentation to automated, real-time evidence generation to survive regulatory scrutiny.

–

Why Your Big Data Project Will Fail Without a Robust Data Governance Strategy?

Big Data projects, with their promise of transformative insights, are often launched with a focus on technology and algorithms, while data governance is treated as a secondary concern. This is a fatal strategic error. In the GDPR era, a Big Data initiative without a robust, integrated data governance strategy is not just at risk of failure; it is almost guaranteed to create massive, unmanageable liability. The very nature of Big Data—ingesting vast, varied datasets and repurposing them for new analyses—is in direct conflict with core GDPR principles like purpose limitation and data minimization.

Without a governance framework, a data lake quickly becomes a “data swamp,” filled with poorly documented, uncatalogued personal data. It becomes impossible to track data lineage, enforce retention policies, or respond to data subject rights requests. When a regulator asks, “What specific personal data are you using in this model, what was the legal basis for its collection, and can you delete it upon request?” an organization without strong governance cannot answer. This inability to account for data processing activities is a critical compliance failure, exposing the entire project and the organization to severe sanctions.

Enforcement trends show that regulators are expanding their focus. As noted by Gustav Lundin, a partner at DLA Piper Sweden, “We are seeing increased oversight in sectors beyond large technology and social media companies.” This means organizations in finance, healthcare, and retail leveraging Big Data are now under the microscope. A data governance strategy provides the necessary guardrails, ensuring that principles of data protection by design are embedded in every stage of the data lifecycle, from ingestion to analytics and eventual deletion. It is the foundational layer that makes innovation legally and ethically sustainable.

Ultimately, data governance is not a barrier to innovation; it is the enabler of it. It transforms data from a potential liability into a well-managed, trusted asset. By establishing clear policies, roles, and technical controls, a governance strategy ensures that your Big Data project can deliver value without bankrupting the company through regulatory fines or a catastrophic loss of public trust. Treating it as an afterthought is to build your project on a foundation of sand.

The evidence is clear: GDPR compliance is not a checklist to be completed but a systemic discipline to be mastered. It requires a fundamental shift in mindset from legal box-ticking to proactive risk management embedded in your technical architecture and operational culture. Begin today by initiating a systemic review of your data governance framework to uncover and remediate the hidden liabilities before they surface in a regulatory audit.